Those considering opening a real estate franchise in 2022 were recently able to unwrap a wealth of information.

NAR recently released its 2021 Residential Franchise Report, which details side-by-side growth information and fees for more than 30 of the largest real estate franchisors. This bi-annual report provides a convenient comparison tool for anyone researching franchises. For those who are willing to unpack the data and look at it from a few different angles, we can uncover powerful stories and trends.

I love this opportunity to see NextHome in context, stacking its basic terms, fees, and nuances right alongside some of the most remarkable players in our industry.

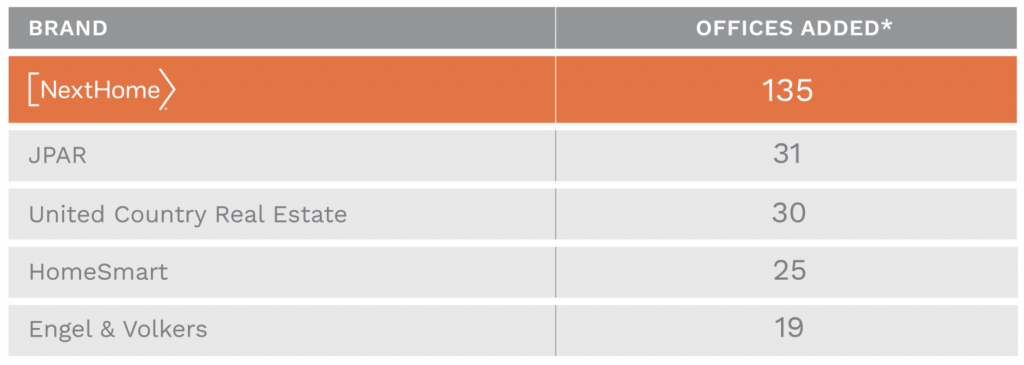

As for highlights, NextHome was No. 1 in net office expansion. We added 135 offices between 2019 and 2021, expanding to 485. For context, JPAR added the second most offices. They began 2019 with 25 offices and now they have 56.

When it comes to attracting new agents, NextHome is the seventh fastest-growing franchise on the list. NextHome added 1,300 agents. For context, KW added 13,560 agents. Both are impressive in their own right. At NextHome, we do not put any emphasis on agent count as we believe quality vs. quantity will always outperform in the market. One is not better or worse than the other but both are very different strategies. I’ll explain later why earning No.1 office growth and unhurried agent growth is a combination we are really proud of.

NextHome was one of three franchises that offered one-year franchise agreement terms, with most companies locking in owners for ten years.

Finally, NextHome’s franchise fees, ongoing royalty fees, and renewal fees were competitively positioned against other franchisors.

For me, this report is like my very own bi-annual report card. It tells me so much about our industry, it puts NextHome in context with other franchise friends, and it uncovers historical trends. It should not have to cost a lot to franchise successfully in this industry, but historically it always has. As the industry evolves in technology, models, flexibility, we believe so should costs.

Before we look at this report in any greater depth, I wanted to pause and talk about the decision to franchise in general. I spend a lot of my time listening to people who are thinking about franchising. As Vice President of Sales, it’s my job and key responsibility. We talk about their questions, concerns, and fears. I hear things like, “It’s too expensive, it’s too restrictive, the terms are too long, and all franchises over promise and under deliver.” And then there are professionals who have franchised before and the experience was terrible.

When I think of the magnitude of franchising, it reminds me of buying my first home. In our personal lives, buying a home is the biggest investment many of us will ever make. You crunch the numbers, you try to think about all the angles, and in the end you hope that you made the most informed decision possible alongside a professional that has guided you smartly and effectively through the process.

I think of the magnitude of franchising in the same way.

In theory, franchising is a fantastic way for entrepreneurs to cut costs, minimize risk, expand more quickly, simplify building out processes and systems, assist in support and training, and leverage brand equity. Also, the risk is a lot less overall. The reward is not having to reinvent the wheel.

However, how can you be confident that the proverbial wheel someone else invented is the sturdiest one on the market?

The NAR Residential Franchise Report offers a convenient way to uncover a wealth of information.

Before talking about different ways we can look at this report, let’s recognize something about data right off the bat: if you torture it enough, it can confess to anything. That’s why it’s important to look at those highlights from a few different angles.

What happens when we put NextHome’s growth in context?

While we recognize what other players in our industry are succeeding at, this report also shows us where contraction is taking place. Almost half of the franchisors in this report experienced net office decreases. Taking associate growth into consideration, that means most other franchises are concentrating more bodies in fewer offices.

Whichever way you slice this, NextHome’s 135 new offices far outpace any growth from any other franchise. And that growth must emphasize quality.

NextHome does not embrace growth for growth’s sake. Not everyone who knocks on our door is a good fit. For every 70-75 people who approach us in any given month, only about 8-15 of those people become owners of NextHome offices.

As much as you are interviewing a franchise, we are interviewing you as well. We don’t want our owners to be exactly the same, but we do need to know that we share many of the same underlying values. Do humans come before houses? Are you willing to emphasize quality in your business? Then let’s talk. This approach has led to mutually beneficial success for every NextHomie.

That emphasis on quality over quantity brings me to agent growth. NextHome started in 2014 with zero agents and zero locations. By the end of 2015, we had over 330 members. Today, over 5,200 NextHomies represent the brand across 550+ locations. However, put in context, NextHome isn’t overflowing with unproductive or part-time agents. KW added 13,560 associates in the same time that NextHome added 1,300. More agents in fewer offices versus more offices and moderate agent growth. More does not always equate to better.

We are happy to add further context to these numbers by exploring a little more the type of associates that NextHome attracts. In short, what return are we reaping for our investment in slower, quality agent growth?

Between 2020 and 2021, NextHome brokerages increased sales volume by 56% and units closed increased by 33%. The average unit sold per NextHome agent is 6.2, while the industry average hovers around 4.5.

When we better understand the demographics and talents of these agents, we also get a better understanding of how the data translates to real-world experience and the overall success of both their and our businesses.

As of March 2021, our franchisees were 61% woman-owned. In addition, 34% of our franchises are minority-owned. Franchise Business Review recognized our workplace culture, naming NextHome to its Top 100 Culture List in 2021. NextHome was also recognized as a top franchise for veterans in 2021.

By unboxing the numbers this way, we get a better view of the stories behind the NAR Residential Franchise Report.

This industry is thirsty for a company that looks at humans and the quality of their talent. Everything we do tells a story, from the number of offices we add to the signs we put in the ground. What’s ahead for NextHome’s future growth? I am both excited and optimistic thinking about how that story will unfold in the 2023 NAR report.

If you would like to become part of the NextHome story we invite you to reach out to us directly by emailing directly franchisesales@nexthome.com or you can call me directly at 925.719.2079.