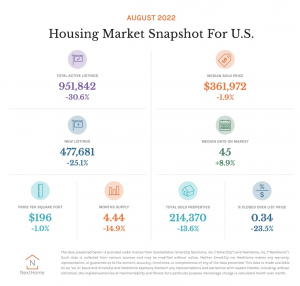

Here is our September housing snapshot, I wanted to unpack a few numbers.

Total listings are down by 30.6% and new listings are only down by 25.1%, how are those two numbers different?

We see this play out when there are properties sitting on the market for longer periods of time. During the last few years we’ve seen an incredibly tight inventory market and basically, as new listings came on the market they would sell and so the variance between total active listings and new listings was very small. We’re seeing this number start to stretch apart from each other as more listings are coming on the market and not selling. That puts upward pressure on the total listing number.

When selling, now more than ever in the last three years, being very thoughtful about how you price your property is critical. You must make an unemotional, honest assessment of what has sold in your neighborhood in the near term. Really, in the very near term, since the market six months ago was a different planet than today’s market as far as real estate is concerned.

I’d add one more thing to call your attention to. Median Sold Price is down -1.9%. However, if you were to pay attention to the headlines you might think real estate was plummeting. Yes home prices are, in macroeconomic terms, starting to retrench, but all real estate is hyper-local. There are many neighborhoods in the country that are performing well and some that are not. Real estate in much of the country will still end the year UP over last year, not down. In August we still have a year-over-year price increase for the 126th straight month. Read that again… for the 126th straight month.

I am in no way saying this market isn’t slowing, it is, but it’s far from the doom and gloom a lot of the headlines are telling.