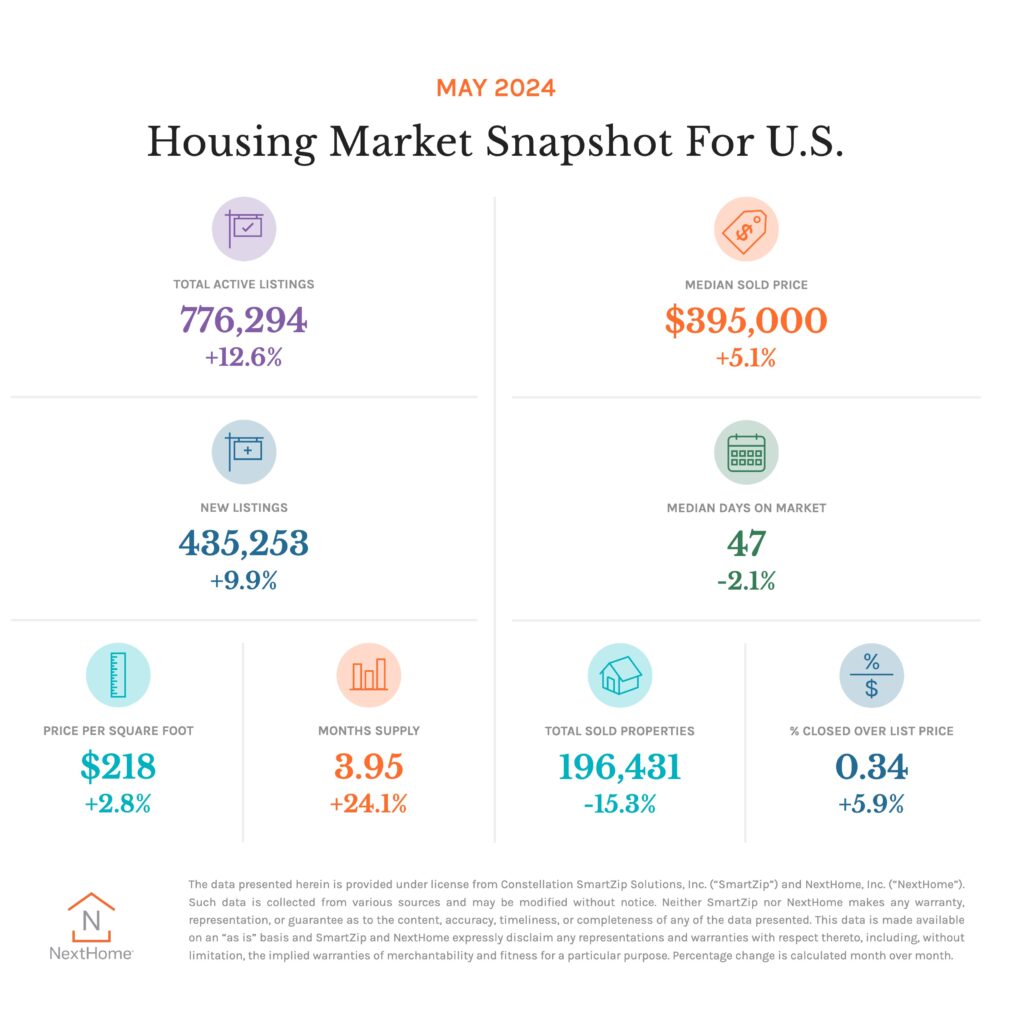

Here is a snapshot of key real estate data for the US in June. Let’s unpack a few of these numbers to understand where the market stands today. For those who prefer a summary, it’s a mixed bag with some critical points to note. To fully grasp what to watch, you’ll need to read through the entire write-up.

Let’s start with New Listings and Total Listings, which are up by 9.9% and 12.6%, respectively. This increase is somewhat normal for this time of year, as more listings typically come onto the market. The pace has picked up from previous years, which were among the slowest on record. So, while this isn’t terrible news, there is a number growing that we need to pay attention to—more on that in a bit.

On the “good news” front, we’ve seen property values hold. The number of homes sold above list price and the median sales price are also up, which is encouraging.

So, more properties are coming into the market, these properties are selling, and values are rising. Where is the “news to pay attention to,” you ask? Here it is: months’ supply. The months’ supply is up 24.1% to 3.95 months of inventory. While four months of inventory isn’t quite tipping into a buyer’s market, a 24% increase in supply, if sustained, will impact values.

I won’t bore you with a long explanation of supply and demand. Simply put, if supply goes up and demand stays the same, prices typically go down. So, what’s happening? There’s enough pent-up demand from buyers who were sidelined by rising interest rates and are now cautiously re-entering the market. They’re not rushing into the real estate market like someone late for their flight, but they are coming back.

However, if that backlog of pent-up demand is worked through and inventory continues to rise, we could start seeing price erosion in residential real estate.

The cure for this? Lower interest rates. Rates have finally cooled off a bit and are slowly decreasing—slowly, like how I get out of bed at 52 compared to when I was 22. If the economy slows and/or the Fed cuts rates, this will put downward pressure on interest rates, increase demand, and lead to a robust summer in real estate. If not, the market could slow slightly, with minor price retrenchment.

To be clear, I anticipate a decrease in the rate of price increases with the possibility of very moderate price erosion in some markets. I am going to say this really loud for the people in the back: NOT A REAL ESTATE CRASH.

So, did we really need this entire explanation to say “it’s all about the interest rates”? Probably not. But context helps.